Federal Capital Gains Tax Rate 2024 Real Estate. For 2024, the irs announced some rule changes on capital gains. Here’s how this change could impact your real estate transactions:.

For 2024, the irs announced some rule changes on capital gains. Biden budget calls for doubling the capital gains tax rate;

Capital Gains Tax Rate 2024.

The tax rates remain the same, but the income thresholds for those rates are moving slightly.

These Numbers Change Slightly For 2024.

The federal capital gains tax rate varies based on income level, asset type, and holding period.

Here’s How This Change Could Impact Your Real Estate Transactions:.

Images References :

Source: realwealth.com

Source: realwealth.com

How to Calculate Capital Gains Tax on Real Estate Investment Property, The 2024 federal budget proposes to increase the capital gains tax inclusion rate to 66.67%. Capital gains tax rate 2024.

Source: burnsandwebber.designbyparent.co.uk

Source: burnsandwebber.designbyparent.co.uk

How Capital Gains Tax Changes Will Hit Investors In The Pocket Burns, For the 2024 tax year, you won’t pay any capital gains tax if your total taxable income is $47,025 or less. Capital gains tax on real.

Source: www.kaigi.biz

Source: www.kaigi.biz

Capital Gains Tax For Jointly Owned Property, Because your income is now $25,000 past the threshold, and that number is the lesser of $75,000 (your total net investment income), then you would owe taxes on that $25,000. Phase out of capital gains rates.

Source: www.transformproperty.co.in

Source: www.transformproperty.co.in

The Beginner's Guide to Capital Gains Tax + Infographic Transform, Phase out of capital gains rates. The budget proposes to tax all capital gains earned by corporations and.

Source: jemimaqmatelda.pages.dev

Source: jemimaqmatelda.pages.dev

Irs Tax Brackets 2024 Vs 2024 Annis Hedvige, The budget proposes to tax all capital gains earned by corporations and. The rates apply to assets sold for a profit in 2024, which are reported on tax returns filed in 2025.

Source: juno.finance

Source: juno.finance

Juno A Guide to Real Estate Capital Gains Tax, The rate goes up to 15 percent. Biden budget calls for doubling the capital gains tax rate;

Source: taxrise.com

Source: taxrise.com

Capital Gains Tax A Complete Guide On Saving Money For 2023 •, The tax rates remain the same, but the income thresholds for those rates are moving slightly. These numbers change slightly for 2024.

Source: ultimateestateplanner.com

Source: ultimateestateplanner.com

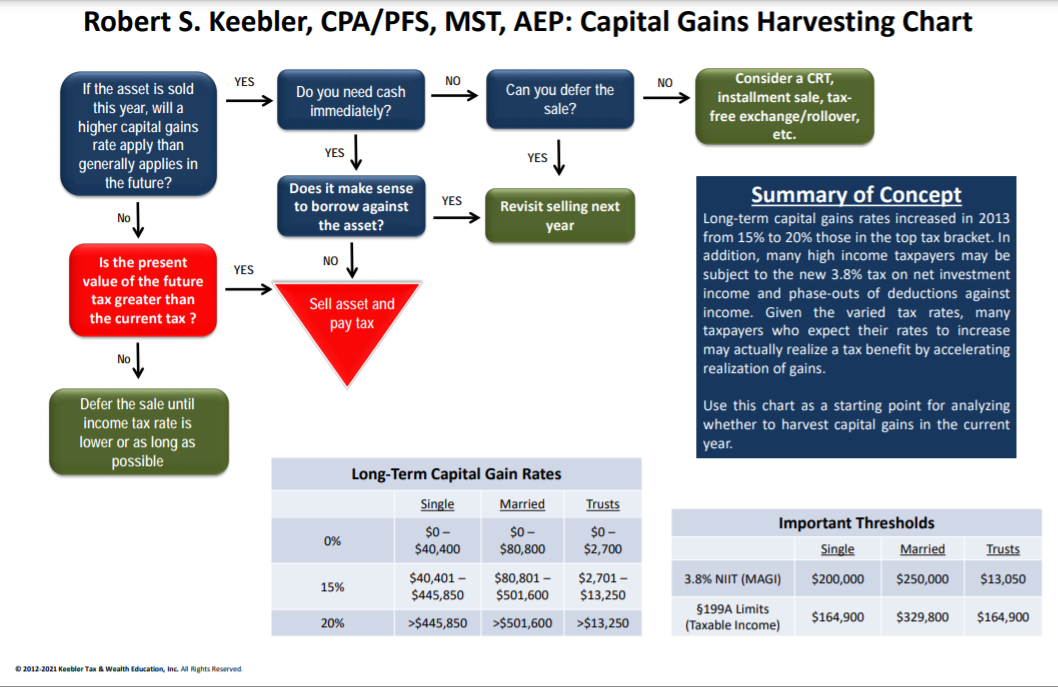

2024 Capital Gains Harvesting Chart Ultimate Estate Planner, Housing and carbon rebates, students and sin taxes. Here’s how this change could impact your real estate transactions:.

Source: thecollegeinvestor.com

Source: thecollegeinvestor.com

Capital Gains Tax Brackets For 2023 And 2024, For 2024, the irs announced some rule changes on capital gains. The capital gains tax rate for a capital gain depends on the type of asset, your taxable income, and how long you held.

Source: www.kaigi.biz

Source: www.kaigi.biz

Capital Gains Tax On Real Estate Investment Property 2019, The 2024 federal budget proposes to increase the capital gains tax inclusion rate to 66.67%. Capital gains tax on real.

The 2024 Federal Budget Proposes To Increase The Capital Gains Tax Inclusion Rate To 66.67%.

What are the capital gains tax rates for 2024?

For 2024, The Irs Announced Some Rule Changes On Capital Gains.

For the 2024 tax year, you won’t pay any capital gains tax if your total taxable income is $47,025 or less.