Federal Tax Table 2025. Overview of federal income taxes. Here’s how that works for a single person earning $58,000 per year:

10%, 12%, 22%, 24%, 32%, 35% and 37%. The 2025 tax year—meaning the return you’ll file in 2025—will have the same seven federal income tax brackets as the last few seasons:

Federal Income Tax System Is Progressive, Meaning Income Is Taxed In Layers, With A Higher Tax Rate Applied To Each Layer.

The rate of social security tax on taxable wages is 6.2% each for the employer and employee.

Here’s How That Works For A Single Person Earning $58,000 Per Year:

Only a portion is refundable this year, up to $1,600 per child.

2025 Provincial And Territorial Income Tax Rates.

The 2025 tax year—meaning the return you’ll file in 2025—will have the same seven federal income tax brackets as the last few seasons:

Images References :

Source: www.taxuni.com

Source: www.taxuni.com

Federal Withholding Tables 2025 Federal Tax, Here’s how that works for a single person earning $58,000 per year: Federal tax brackets for 2025.

Source: justonelap.com

Source: justonelap.com

Tax rates for the 2025 year of assessment Just One Lap, Overview of federal income taxes. Last year, the same tax rate took effect for single.

Listed here are the federal tax brackets for 2025 vs. 2022 FinaPress, There are seven federal tax brackets for tax year 2025. 2025 tax rates for other filers.

Source: calendar.cholonautas.edu.pe

Source: calendar.cholonautas.edu.pe

Tax Rates 2025 To 2025 2025 Printable Calendar, The federal tables below include the values applicable when determining federal taxes for 2025. Federal income tax system is progressive, meaning income is taxed in layers, with a higher tax rate applied to each layer.

Source: www.taxpolicycenter.org

Source: www.taxpolicycenter.org

T130159 Baseline Distribution of and Federal Taxes; by, For single filers and married individuals filing separately, it’s $13,850. Single taxpayers 2025 official tax.

Source: federalwithholdingtables.net

Source: federalwithholdingtables.net

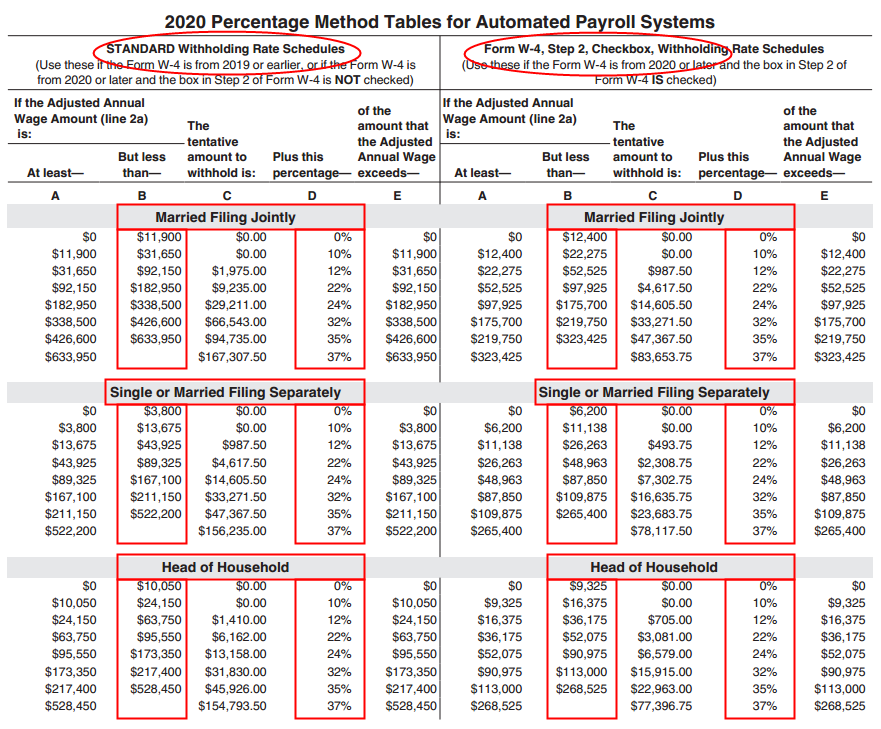

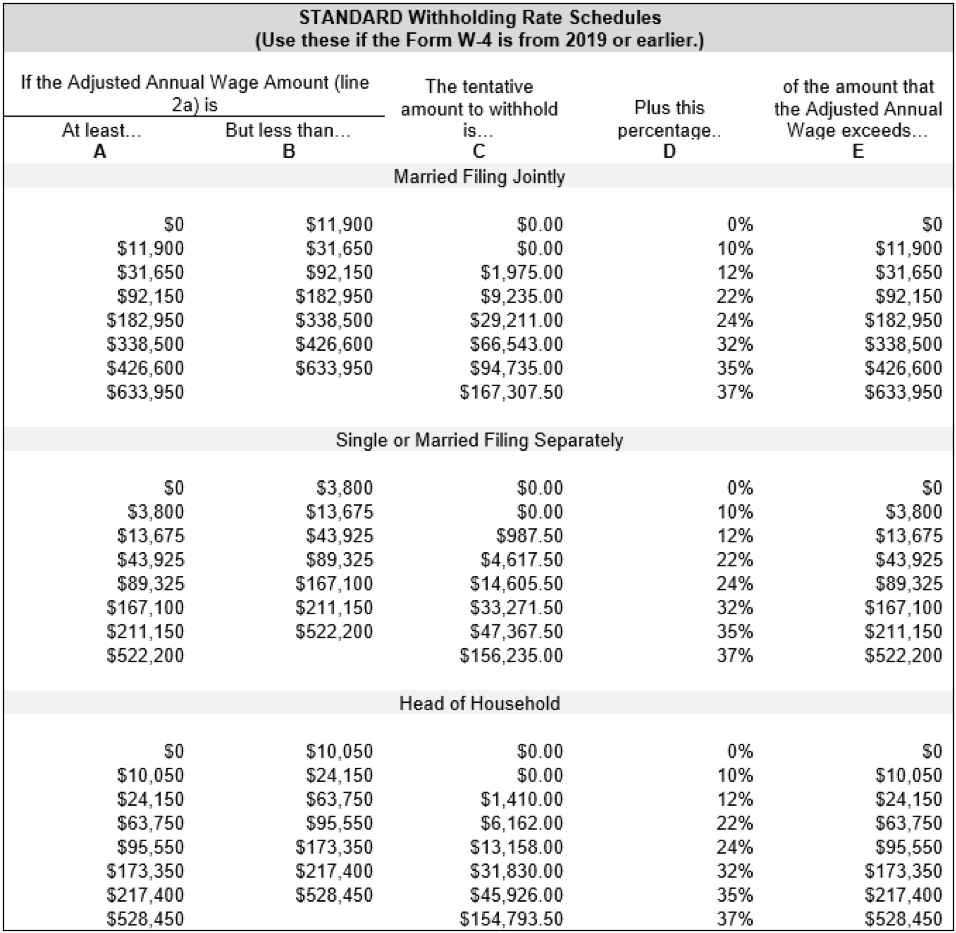

IRS Tax Tables Federal Withholding Tables 2021, Understanding how your income falls into different tax brackets can help with tax. Taxable income and filing status determine which federal tax rates apply to.

Source: www.axios.com

Source: www.axios.com

Here are the federal tax brackets for 2025, This page explains how these tax brackets work, and includes a. Federal income tax system is progressive, meaning income is taxed in layers, with a higher tax rate applied to each layer.

Source: proper-cooking.info

Source: proper-cooking.info

2022 Federal Tax Tables, The 2025 tax year—meaning the return you’ll file in 2025—will have the same seven federal income tax brackets as the last few seasons: This page explains how these tax brackets work, and includes a.

Source: bingerbarcode.weebly.com

Source: bingerbarcode.weebly.com

Irs 2020 tax tables bingerbarcode, Enter your total federal income tax withheld to date in 2025 from all sources of income. Federal tax brackets for 2025.

Source: federal-withholding-tables.net

Source: federal-withholding-tables.net

Employer's Federal Withholding Tax Tables Monthly Chart Federal, Marginal tax rate (%) of the amount over. The rate of social security tax on taxable wages is 6.2% each for the employer and employee.

Enter Your Total Federal Income Tax Withheld To Date In 2025 From All Sources Of Income.

Last year, the same tax rate took effect for single.

The Social Security Wage Base Limit Is.

2025 federal income tax rates.

Additional Federal Tax For Income Earned Outside.

For single filers and married individuals filing separately, it’s $13,850.

Posted in 2025